Cabinet Approves Taxation Areas for Real Estate

The decision of the Cabinet of Ministers on approval of the boundaries of zones of the city of Baku, including settlements and villages, has entered into force in connection with the application of the new rules of the simplified tax payment on the sale of housing and non-residential areas.

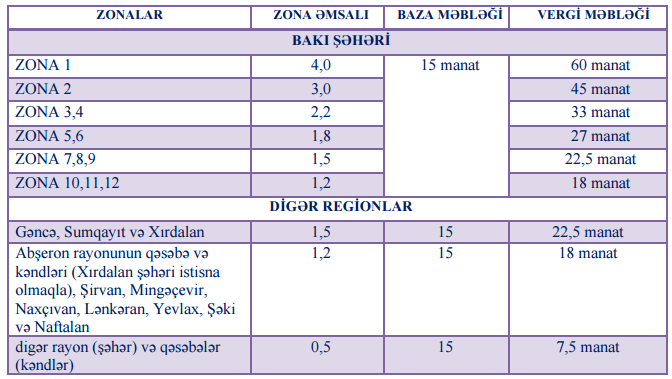

The document is required for the performance from January 1, and corresponds to Article 220.8.1 of the Tax Code of Azerbaijan. For builders, the base tax rate is 45 manats per 1 sq.m., for individuals who own housing - 15 manats per 1 sq.m.

The capital has been divided into 12 zones, each of them is applied a coefficient - maximum 4-fold is applied to the first zone. In the second zone, the base rate is multiplied by 3, in the third and fourth - by 2.2, in the fifth and sixth areas - by 1.8, in the seventh, eighth and ninth - by 1.5, in the tenth, eleventh and twelfth - by 1.2.

Upon the sale of administrative and commercial facilities their owners will pay 1.5 times more than in the sale of housing.

There are exceptions to the rule - tax exempt are owners of residential areas, where they live for more than 5 years, and those who give their property to family members. The same applies to material support and inheritance, real estate acquisition for state needs, the joint property of spouses, including its transfer in divorce proceedings. --17D-

Economics

-

Azerbaijani President Ilham Aliyev has signed amendments to two presidential decrees, refining the roles and appointments of the State Customs Committee's representatives abroad, including in international organizations.

-

Auditing organizations and independent auditors in Azerbaijan concluded 7,232 contracts valued at 133.2 million manats ($78.4 million) in 2023, reflecting increases of 20% in the number of contracts and 7.1% in their total value compared to the previous year, according to the Chamber of Auditors.

-

The third meeting of the auction commission was held to evaluate the proposals submitted by participants in the auction for the Gobustan Solar Power Plant project, supported by the European Bank for Reconstruction and Development (EBRD). The meeting focused primarily on determining qualification eligibility and selecting the auction winner, according to the State Agency for Renewable Energy Sources.

-

There is no sensationalism in the recent renaming of the Azerbaijani ship Karabakh to Mingachevir; the new name was given to the ship to ensure that two vessels would not operate under the same name, the Merchant Fleet of Azerbaijan Caspian Shipping Company (ASCO) CJSC told Turan.

Leave a review