SOCAR Leads in Tax Compliance Among Ukrainian Gas Stations, Study Finds

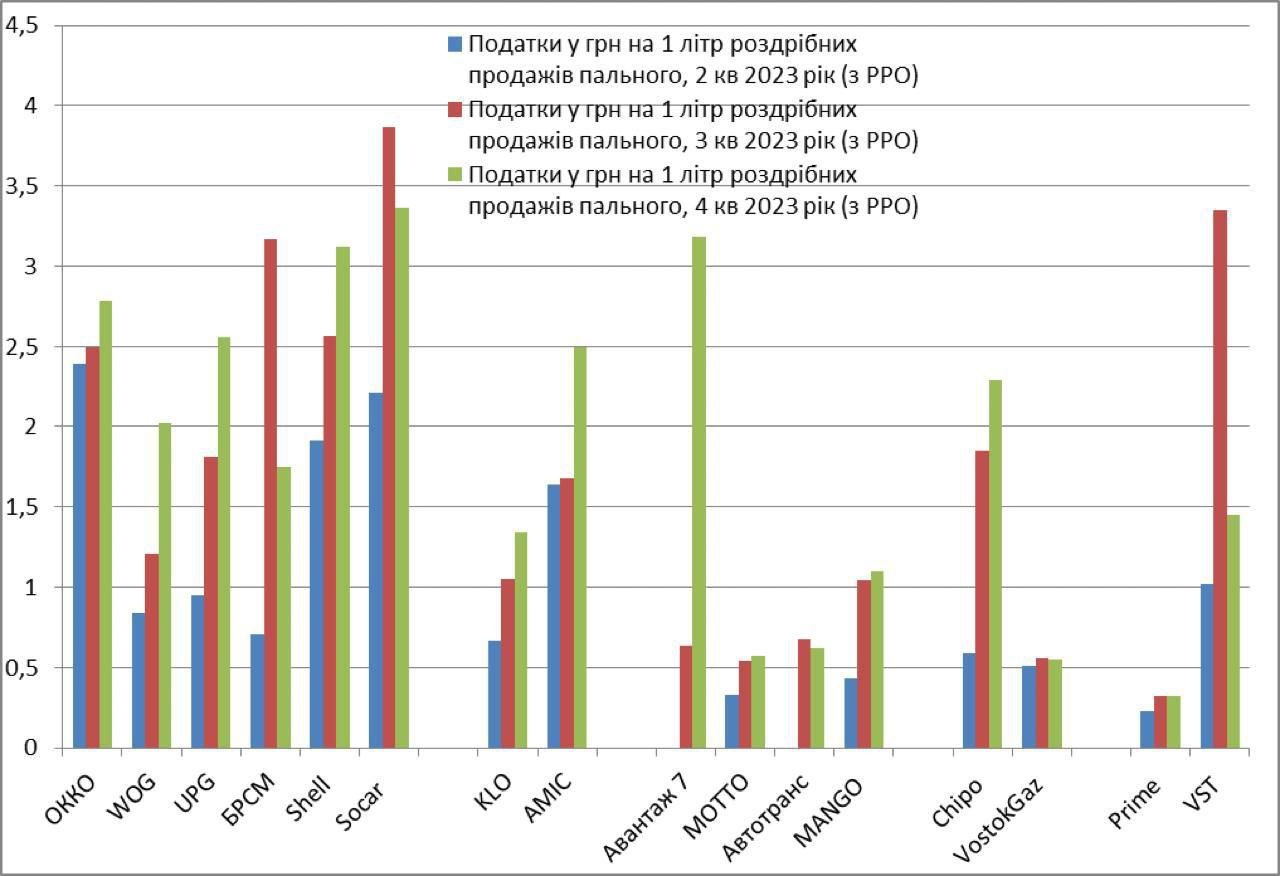

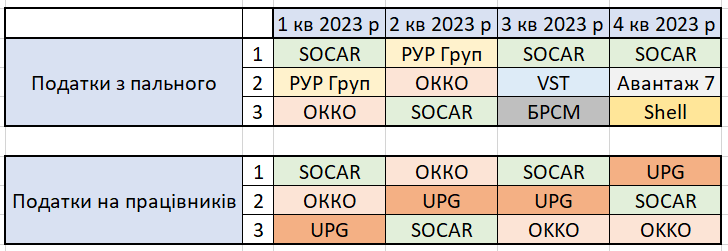

A recent study by the Institute of Socio-Economic Transformation (ISET), the CASE analytical center, and the Economic Expert Platform has revealed that the State Oil Company of the Azerbaijan Republic (SOCAR) topped the list of taxpaying gas stations in Ukraine last year. According to the research, in 2023, SOCAR led in paying fuel taxes in three quarters and payroll taxes in two quarters, as reported by tsn.ua.

The study aimed to explore the dynamics and shadow share of excisable goods, with a particular focus on fuel. Excise taxes, as explained by the researchers, serve a dual purpose: they are meant to discourage the consumption of certain goods through demand elasticity and to provide a less harmful way to fill state budgets compared to other taxes.

The onset of a full-scale war has slightly increased the shadow sales of excisable goods, mainly due to a steep decline in legal sales. Despite this, concerted efforts throughout 2023 have dramatically reduced the shadow economy's share, with the illegal market contracting by two and a half times over the year.

For the study, researchers employed data from Ukraine’s energy balance—issued annually by the State Statistics Committee of Ukraine—alongside estimates of total fuel consumption based on the average mileage of vehicles. This approach allowed for a comprehensive assessment of the excise tax coverage on both domestically produced and imported fuel.

Comparative analysis of tax payments by major Ukrainian gas stations highlighted SOCAR’s compliance in both retail sales and employee taxation. This distinction not only reflects SOCAR's commitment to regulatory compliance but also underscores its significant role in Ukraine's fuel market amid challenging economic conditions.

Leave a review