Добыча нефти в Сибири. Arxiv

It happened! The “oil war” between Russia, on the one hand, the United States and Saudi Arabia, on the other hand, ended and OPEC and a number of other countries outside the cartel agreed last Sunday to reduce oil production.

The new agreement provides for a reduction in oil production from the level of October 2018: by 23% in May-June, 18% - until the end of 2020 and 14% - until the end of April 2022. At the first stage, the alliance will reduce production by 9.7 million barrels, then by 8 and 6 million. For Russia and Saudi Arabia, the reference base will be 11 million barrels per day. Mexico insisted on separate conditions; it reduces production by only 100 thousand barrels per day in May-June, and the United States compensates for the rest.

And this result was quite predictable. The deal was concluded on extremely unfavorable conditions for Russia. If on March 6, before the OPEC + meeting in Vienna, Minister of Energy of Russia Alexander Novak loudly slammed the door, it was a question of reducing its production by 0.5 million barrels per day (since oil consumption around the world began to fall due to the total economic situation, which was extremely negatively affected by the Corona Virus pandemic and forced universal quarantine), now it’s 2.5 million, that is, 5 times more.

No one is talking about the United States joining the deal. They reduced production by 250 thousand barrels (10 times less than Russia), but not as part of a new deal, but purely for economic reasons - due to lower demand. This means that at any moment, American oil producers of low-permeability reservoirs (called shale by journalists) are not bound by any restrictions and can increase production again, but Russian ones cannot because of quotas.

It should be noted that since 2013, US oil production has been steadily growing, having increased by about three times today, which is a lot. Accordingly, OPEC + countries are constantly reducing their production, thereby maintaining prices at a fairly comfortable level. At the same time, the main burden fell on Saudi Arabia.

Russia has been involved in this deal for three years, and if you look at the production growth schedule in this country, it turns out that it has not declined over this period. Moreover, there was growth (albeit moderate). I.e. formally, verbally joining the deal, de facto Russia did not reduce production. And for the time being, it suited everyone.

The exact same situation developed in the early 80s of the last century. And then the OPEC countries reduced production, and then, as today, a significant proportion of the reduction accounted for Saudi Arabia. The Soviet Union made good money on this. It was stepping up prey. Its peak was reached in 1987. It is clear that in those years, no deal with OPEC + was on the agenda, and the USSR was a socialist country and adhered to completely different principles. Nevertheless, this did not prevent the USSR from earning excellent money under conditions when Saudi Arabia and some other OPEC countries were forced to reduce their production.

In the end, the patience of Saudi Arabia was exhausted and from September 8, 1985, it stopped cutting production, which had far-reaching consequences for the USSR.

A similar situation has developed on March 6. The Russian leadership nevertheless has learned some lessons since 1985. It tried to somehow communicate with OPEC. True, more in words than in deed. But, when it was strongly demanded to reduce production, it refused that. At the same time, the potential of Russia to increase production amounted to a maximum of 0.2-0.3 million b / d, while it exported about 4.99 million b / d of crude oil and about 3 million b / d of oil products. Against this background, Russia demanded a fairly modest reduction. Russia has refused this reduction. This enraged the Saudis and they began not only to actively sell oil from their reserves, but also to offer fairly aggressive discounts to buyers of Russian oil. This provoked a sharp decline at the very beginning of March. These events were superimposed by a much stronger drop in oil demand, which arose because quarantine measures were launched en masse in Europe and the USA in connection with the Corona Virus epidemic.

From now on, the excess supply of oil on the market (the numbers are floating there) can be roughly estimated as 20 million bps. This is completely unprecedented. This is a huge number. To assess the scale of the disaster, it should be remembered that in 1985-1986, the Saudis also aggressively threw their oil into the market - 3-3.5 million b / d additionally.

In those years, the world market was slightly smaller (by 3.5 - 4%). With this imbalance, the price fell almost 4 times.

At the end of 2014 and the beginning of 2015, an excess of oil reappeared on the market (approximately 3 -3.5 million b / d). And then, like the 80s, the price fell by the same 4 times. Hence the conclusion - a market imbalance of 3 - 3.5% causes a fourfold drop in prices. Today, the imbalance in the market is approximately 20%. One must have a very strong imagination to imagine what will happen to the oil market if some extraordinary measures are not taken.

A huge excess of oil supply has formed on the world market. The situation is such that significant volumes are now pumped into the reserve. During the Arab-Israeli conflict of 1973, when there was an oil embargo (primarily from the side of Saudi Arabia and other Arab countries), a shortage arose and cars stopped. It was a real disaster, which went down in history as the “oil shock of 1973.” After that, most developed countries created fairly powerful oil reserves. The United States, without production, without oil imports, can live about two hundred days at the expense of its reserves. China has substantial reserves. But they are not able to accept 20% of oil surplus into any storage facilities. If something does not radically change for the better, then on the horizon 5 weeks - 2 months, then we will see the second series of collapse of the oil market.

OPEC + countries have agreed. However, it is worth noting that these agreements are not very clear and most likely, they will be repeatedly specified. It is a question of reducing production by 10 million bpd. A number of countries that cannot in any way join the de jure agreement due to falling prices are likely to reduce production due to market influence and they will remove another 5 mln bpd. This will eliminate a significant portion of the imbalance.

Problems of Russia

For Russia, this situation looks very complicated, including for purely technical reasons. A significant part of Russian oil is produced in the cold climatic zone and therefore it is simply impossible to take and block the well. A significant part of Russian fields has a high water cut - not pure oil comes from the well, but the so-called well liquid, where oil is 15%, or even less. And in these conditions, shutting down a well requires time, teams, special equipment, etc. Another problem is that in Russia the fields are old and the old ones produce much less oil. Therefore, the number of wells that need to be shut to fulfill the agreement is too large and stopping them is a rather difficult task. Where can Russian companies get equipment and specialists to quickly preserve wells? It is generally not clear how Russian companies will implement this decision.

It is also worth noting that the specifics of the old fields are such that if it is located in an area with a very high water cut of the reservoir, then after decommissioning it, it is either technically difficult or quite expensive to restart it. At low oil prices, this will make the launch of plugged wells completely pointless from an economic point of view.

In addition, in the production of oil, in addition to variable costs (the higher the production, the greater the cost), but there are also fixed costs - the costs of maintaining the infrastructure (pipelines, maintaining or simply protecting the pumping stations (booster pump stations - the technological part of the oil recovery system and gas in the fields and their subsequent transportation), dispatch services, etc.). Modern deposits require a lot of staff and costs. And even if it is idle, so that they do not collapse, you need to spend money on maintaining the infrastructure. As a result, the reduction in production leads to a linear decrease in cash flow. They reduced production - they began to receive proportionally less money. A reduction in production by Russia is impressive (about a quarter!) And therefore will be quite painful. It is not a fact that after this reduction, it will be possible to fully restore the mining capacities.

And there is one aspect more. Graphically, production from any field looks like a bell-shaped curve. When the field is young, production increases, reaches its peak, after which a decline begins.

By the time of the collapse of the USSR, the peak reached in production had fallen by about half. The USSR did not have the resources to carry out maintenance work, etc. Actually, the revival of the Russian oil sector is associated with the advent of modern technologies to enhance production, which allowed increase in the production in old fields, together with Western oilfield service companies. And now Russia produces even a little more than the USSR in 1987.

By the way, a very interesting detail - all oilfield service companies operating in Russia are Western. These are the French Schlumberger and the American ones - Halliburton, Baker Hughes, National Oilwell Varco and Weatherford. Therefore, in order to reduce oil production in Russia, you can not even enter anything. It is enough to stop some types of service and at a rate of 2 to 5% per year production will begin to decline without any effort. Because the reserves are depleted and only oilfield services manage to keep it at the current level.

The question arises - will Russian companies have enough resources, including money, to maintain such a level of oilfield services that will allow them not to fall further downstream? The intrigue is this. And since such technical details were not disclosed by the companies, until at least a couple of quarters after the decline in production, it is difficult to say how the Russian oil companies will survive such a drop in revenues. No less interesting is the question - how will the decline in exports affect the industry as a whole, the federal budget revenues?

Will Russia fulfill its obligations?

Based on previous experience, we can assume that now Russia will not comply with the terms of the agreement. But this time, it’s unlikely to risk doing this. For the following reasons: now the excess of oil on the market is so great, so threatening that in return you can get full-fledged sanctions on Russian oil. How these sanctions are in effect, Russia could be convinced by the example of Nord Stream-2. Just a few hours after receiving the letter (generally speaking, an informal, friendly letter signed by 6 senators), the Swiss company Allseas recalled its Solitaire pipe-laying vessel from the North Sea because of such a thing as secondary sanctions (the imposition of sanctions on persons facilitating the transactions of sanctioned persons). This is such a powerful tool and in conditions when the market is oversaturated with cheap oil, you just have to be kamikaze in order not to join the sanctions if they follow. Therefore, in these conditions, any violations are extremely unlikely simply because of the fantastically high price. If sanctions are imposed, this will mean that Russian oil is worth "0".

In the current market there are many states and companies that would simply welcome this. To risk such violations is complete insanity.

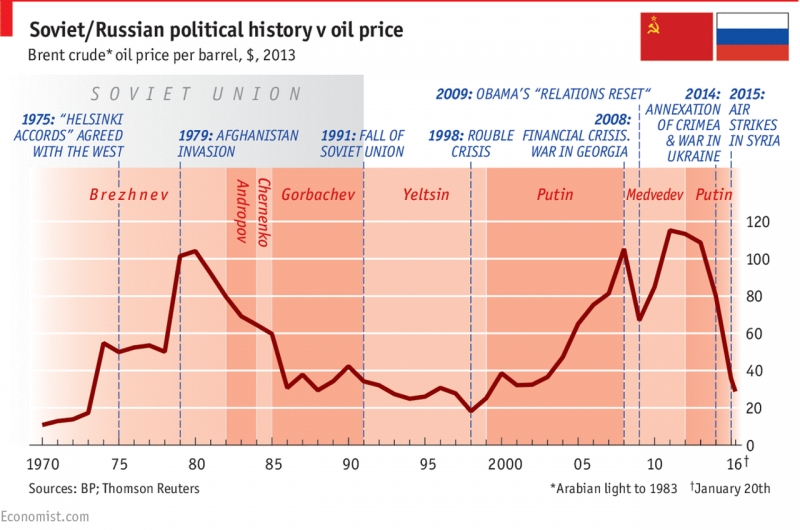

Chart from the Economist magazine

The Economist magazine once published a curious chart. It reflects the fluctuation in the cost of Russian oil in terms of dollars at the 2013 exchange rate.

And the leaders of the USSR and Russia are plotted on the same diagram, events - the invasion of Afghanistan, etc.

The golden years of the USSR are the second half of the 70s and the first half of the 80s.

In1975, a landmark political event occurred - Leonid Ilyich Brezhnev signed the Helsinki Accords. This meant that the USSR refuses any aggressive action in Europe. And when this happened, the increase in the cost of energy resources began, plus a strong softening of political relations, primarily with Europe, the USSR began to massively build oil and gas pipelines.

The contract of the century (construction in 1983 of the Urengoy-Pomary-Uzhgorod gas pipeline for the supply of natural gas from fields in the north of Western Siberia (Tyumen) to consumers in the Union Republics and countries of Central and Western Europe) - when the USSR received pipes in exchange for future gas supplies large diameter, technology, German banks credited the USSR and, accordingly, oil and gas pipelines were built.

Since the beginning of the 80s (in 1982, the Arab-Israeli war broke out) there was a fourfold increase in oil prices and in a short time the golden rain fell on the Soviet Union. And from that moment on the USSR literally paralyzed on the policies of OPEC countries. Saudi Arabia was cutting back on production and saw that, in principle, it was parasitized. The dissatisfaction of Saudi Arabia and many other countries began to grow in the Soviet invasion of Afghanistan. And then, on September 8, 1985, the Minister of Oil of Saudi Arabia, Sheikh Ahmed Zaki Yamani, said: “Now we are starting to fight for a place on the market” and an excess of oil surged into the world market. This excess led to a drop in prices.

Since the beginning of the 2000s, when Vladimir Putin came to power in Russia, a golden rain fell on this country again. Under the presidency of Dmitry Medvedev, in August 2008 there was a Russian invasion of Georgia and the annexation of Abkhazia and South Ossetia - oil prices collapsed. Putin's return to power was marked by a sharp increase in oil prices, but after the annexation of Crimea and the intervention in Syria, prices fell again.

And what about the “damned Pindos”?

As for the United States, they cannot formally join the agreement, even if President Trump really wanted to. This directly violates the “Act on the Protection of Trade and Commercial Activities from Unlawful Restrictions and Monopolies” (Sherman Antitrust Act, 1890), which expressly prohibits cartel conspiracy.

It is impossible to do this directly. But, lower prices will lead to the fact that part of the shale oil producers will reduce production.

When the price fell sharply in early 2014 - late 2015, 2/3 of shale oil production was reduced. When it grew, they also quickly grew. Therefore, US oil production will be reduced, but this will not be in the nature of a cartel conspiracy, but rather for market reasons. How much, it’s too early to predict.

***

Despite the new agreement on reduction of oil production concluded by the OPEC + ministers, the cost of raw materials will continue to fall. The current deal is not enough to raise prices, analysts at one of the world's largest investment banks, Goldman Sachs, say.

Any agreement will not be enough to compensate for the already occurring sharp drop in demand. Commodity prices are expected to fall in the coming weeks, as oil depots are filling up too quickly due to lower demand due to the spread of the Corona Virus and related restrictions.

Leave a review