From the point of view of outcome evaluation, the volume of any flows in the balance of payments determines the increase and decrease of the country's foreign exchange reserves. Any information in the balance of payments is very important in terms of having a clear idea of the country's foreign economic activity.

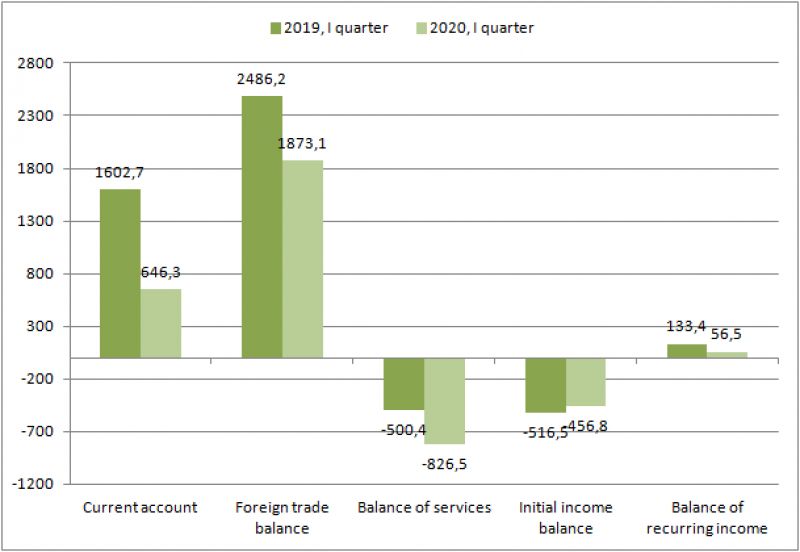

According to the Central Bank, in the first quarter of 2020, Azerbaijan's balance of payments showed a deficit of $ 1.3435 billion. However, in the first quarter of 2019, a surplus of $ 2.019 billion was formed in the balance of payments. The reason for the current year's deficit was directly related to the decline in oil and oil products which are dominant in exports and the increase in imports.

The balance of payments determines the ratio between foreign exchange inflows and outflows to the national economy as a result of international economic transactions. The deficit is the result of the currency leaving the country exceeding the currency entering the country. In the first quarter of 2020, money transfers from Azerbaijan abroad increased by 37 percent compared to the same quarter of 2019. Let's pay attention to the opposite process. At the same time, money transfers from foreign countries to Azerbaijan decreased by 12.5 percent. 46% of money transfers fell to the share of Turkey and Russia. This means that about half of the funds went to these two neighboring countries. More than half of the funds coming to our country from abroad - 51% - came from neighboring Russia. This is not just an economic indicator. It is also a manifestation of the vector of migration. It indicates the geography of the countries where people go to find a job. Another conclusion drawn from this is that the volume of foreign output exceeds the amount of financial transfers received in our country. Specifically, the level of outflow of migrant capital outside the country has increased significantly.

In our previous articles, we provided information on the structure of imports and exports of the balance of payments. Since the part we did not analyze is related to the structure of the Balance of Services, let's evaluate and analyze them now.

In the first quarter of 2020, the total volume of services in Azerbaijan's economic relations with foreign countries amounted to $ 2.2 billion. Of this, $ 1.5 billion falls to services provided by non-residents to residents of Azerbaijan, and $ 0.7 billion falls to services provided by residents of Azerbaijan to residents of foreign countries. As a result, the deficit in the balance of services increased 1.7 times to $ 0.8 billion. The balance of services deficit in the oil and gas sector (mainly construction services and other business services) amounted to $ 634.3 million. The balance of services deficit in the non-oil sector amounted to 192.2 million. This also shows that the potential of market participants in the non-oil sector is declining.

The turnover of mutual tourism services in the first quarter of 2020 decreased by 18% to $ 549 million. During the reporting period, a deficit of $ 14.3 million (a decrease of 2.3 times compared to the same period last year) was created as a result of the excess of imports ($ 281.7 million) over exports ($ 267.4 million) for tourism services. This also means that the income from tourism services in our country has decreased in the 1/5 ratio. During the reporting period, the number of Azerbaijani citizens traveling abroad decreased by 23%, and the number of foreign citizens visiting Azerbaijan decreased by 15%.

30% of the turnover of mutual services falls on transport services. Our analysis of transport services shows that during the current period, exports of transport services in the non-oil sector decreased by 0.2% compared to the same period last year, while imports increased by 44.7%. As a result, the deficit under this subject, which was $ 27.1 million in the first quarter of 2019, increased 5.4 times in the first quarter of 2020 and amounted to $ 146 million.

Based on statistical comparisons, we can say that the balance of payments deficit was due to the decision of devaluation in 2015. It was in the first and fourth quarters of 2015 and in the first quarter of 2016. From that period to the first quarter of 2020, surpluses were recorded in all quarters without exception. In other words, the volume of currency coming to our country exceeded the volume of currency outgoing. From this point of view, we can compare the deficit in the first quarter of this year only with the impact of the decision of devaluation in 2015.

Results and forecast: Based on the results of the first quarter of this year, we can predict that the actual results of the second quarter will be more severe. Because near the end of the first quarter, the price situation for oil changed dramatically. The two-month average oil prices were not considered a serious reason for the deterioration of macroeconomic indicators. However, the indicators of the last month changed the results of the first quarter. In the second quarter, oil prices did not exceed $ 30-35.

Mohammed Talibli

Leave a review