We are approaching the end of the year. The deterioration of macroeconomic indicators is a reality. One of these indicators is related to the decrease in total (domestic and foreign) investment. If in January-November 2019, the volume of GDP amounted to 64.7 billion AZN, this year - in the same period in 2020, this figure was 61.9 billion AZN. This means that 2.8 billion AZN or 4.3% fewer goods and services were produced during this period. In the structure of GDP, we can see that the volume of investment is also reduced. Our analysis shows that compared to January-November last year, 4% fewer funds were received in fixed assets this year.

In January-November this year, 12.7 billion AZN was invested in fixed assets in our country. If we group this investment "pie" by oil and non-oil sector, it will be clear that while the oil sector attracts more funds, the inflow of private investment in the non-oil sector has weakened. Investment in the oil and gas sector, which has long been dominated by sectoral foreign investment, increased by 8.4%. However, the non-oil sector decreased by 11%. An analysis of the volume of investments shows that only 66% of the accumulated investments were for production purposes.

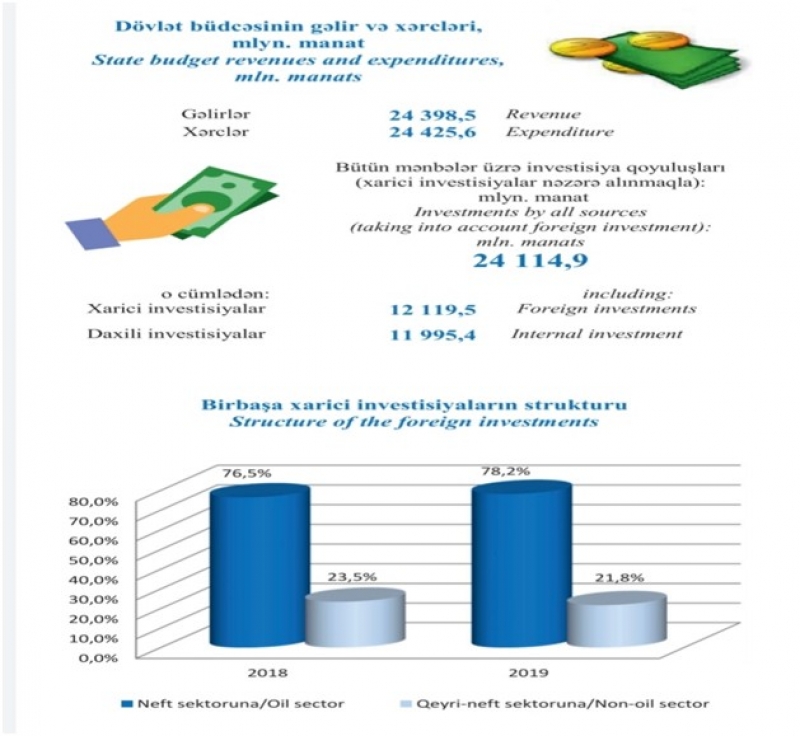

Source: SSC, “Azerbaijan Facts and Figures 2020” Bulletin

According to the balance of payments for 2019, 78.3% of foreign direct investment in this period fell to the oil and gas sector. Last year, foreign direct investment in the non-oil sector amounted to $ 930.1 million (a decrease of 3.8%), the share was 21.7%. According to the Central Bank of Azerbaijan (CBA), in 2019, Azerbaijani companies invested $ 2.4 billion abroad (an increase of 38.1%), including $ 978.8 million in the oil and gas sector (an increase of 54.5%), $ 1 billion 452.9 million (an increase of 28.9%) in other sectors. It is obvious that in 2019 compared to 2018 and in 11 months of 2020 compared to January-November 2019, there is a decrease in investment. With the exception of the current year, the weak attraction of investments in previous years is due to subjective factors. The decline in the current year was due to global trends. Because similar situations are happening in other countries too. Such that in the first half of 2020, global direct investment decreased by 49% compared to 2019. The reason for this was the negative impact of pandemics and quarantine on investment projects, as well as the recession caused by them. A new report from the United Nations Conference on Trade and Development (UNCTAD) says that this downward trend affects all major forms of foreign direct investment. The report also noted a significant decline in investment in countries with developed economies. For example, foreign direct investment in North America fell by 56% to $ 68 billion. In Asia, the decline in foreign direct investment was only 12%, especially due to high rates in China. Due to the sharp decline in Russia, the volume of foreign investment in countries with transition economies decreased by 81%. These trends allow us to say that the outlook for investment is vague or uncertain. This uncertainty stems from the effects of COVID-19, as well as geopolitical risks.

However, in the current situation, which causes the investment "hunger" of the Azerbaijani government, the main issue is the need to attract more domestic and foreign investment. Attracting investment in Nagorno-Karabakh, which has been liberated from occupation, should become a top priority for the government. On the one hand, multi-vector incentive mechanisms to attract foreign investment should be developed and carried out by restricting the outflow of migrant capital. It is very difficult to combine these two important tasks in a fragile economic situation. Developing countries are implementing proper investment planning to get out of the trap of speculative investment and get rid of such fragility.

Will we be able to do that?

Mohammed Talibli

Leave a review